NOW SELLING

Loft-Style Living in Sacramento

Minutes from Downtown. The ultimate urban lifestyle.

NO UPKEEP

OPEN PLANS

FROM THE

LOW-$300s

BALCONIES

AMPLE STORAGE

01

THE HOMES

One size doesn’t fit all. But three do.

The Central Lofts at The Mill offer something for everyone.

Each six-home building offers three unique plans, ranging from an efficient 1 bedroom studio-style home to a large 3-bedroom 3-bath home. Whether you’re looking for a minimalistic lifestyle that’s easy to maintain or you desire a larger home for your family or roommates, the Central Lofts deliver.

Illustrative balcony shown from The Mill at Broadway’s Cottages Residence One

02

FEATURES

Each home features at least one generously-sized outdoor balcony, offering outdoor living without the upkeep or headache of a yard.

02

FEATURES

All the exterior maintenance of your home and upkeep of the common areas is handled by the HOA, meaning you can focus on what you want to do, not what you have to do.

02

FEATURES

The Central Lofts, with keyless entry and limited exterior access, are the perfect lock-and-leave homes, offering peace of mind whether camping in Tahoe or on a trip across Europe.

02

HOME FEATURES

The Central Lofts are across from the community park, the plaza, and the future market building. And, just like all homes at The Mill, they’re just minutes from everything you love in Downtown Sacramento.

02

HOME FEATURES

Own a Home, Not a List of Responsibilities

The Central Lofts offer freedom to live however you want without having to deal with roof repairs, exterior maintenance, landscaping upkeep, or a landlord. Plus, the Central Lofts include brand-new everything and a home warranty, offering you hassle-free living.

KEYLESS ENTRY

PRIVATE GARAGE

BIKE STORAGE

MODERN DESIGN

HIGH EFFICIENCY

OUTDOOR LIVING

NO MAINTENANCE

QUALITY FINISHES

03

FLOOR PLANS

A Plan for Everyone

CENTRAL LOFTS

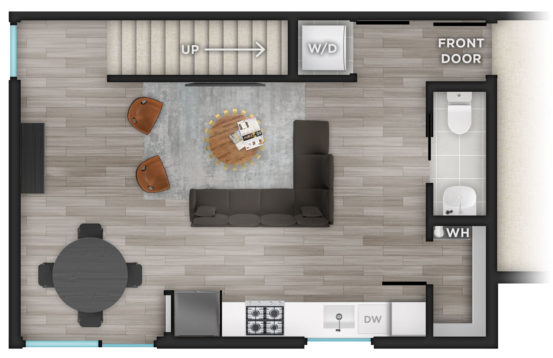

Residence One

From the low-$300,000s

A compact home that lives large, with an open floor plan, double-height ceiling in living area, and loft-style upstairs bedroom with private balcony.

CENTRAL LOFTS

Residence Two

From the high-$300,000s

Dual balconies flood this home with natural light, and double-height ceilings in the living area create a sense of openness. The loft level can be used as a second bedroom, office, or media area.

CENTRAL LOFTS

Residence Three

From the high-$400,000s

This home offers an optional ground-floor studio with kitchenette, perfect for guests or a roommate. Enjoy direct access from the garage, a large kitchen island, and dual balconies, including a wrap-around balcony off the owner’s suite.

From Our 200+ Residents…

04

THE COMMUNITY

The Mill offers more than beautiful homes

Enjoy amenities you won’t find at any other community in Sacramento

NEW PARK

Only steps from the Central Lofts

EV ACCESS

Resident-only EV rentals by the minute

DOWNTOWN

Just minutes from Downtown Sacramento

TRAIL ACCESS

Access to the American River Bike Trail

05

LOCATION

Close to Downtown.

Far from the congestion and noise.

1.4 mi.

TO STATE CAPITOL

1.4 mi.

TO GOLDEN 1 CENTER

0.4 mi.

TO MAJOR FREEWAYS

Contents of this website are intended for information only. All information (including but not limited to prices, availability, incentives, floor plans, site plans, features, standards and options, assessments and fees, planned amenities, programs, conceptual artist renderings, and community development plans) is not guaranteed and remains subject to change or delay without notice. Maps and plans are not to scale and all dimensions are approximate.

This site is not a part of the Facebook website or Facebook Inc. This site is NOT endorsed by Facebook in any way. Facebook is a trademark of Facebook, Inc.